Establishing Bounds for Miner Revenue in EIP-1559

Feb 26, 2021 | hasu, Georgios Konstantopoulos

Goal of the analysis

- Establish lower, middle and upper bounds for how much miner revenue will be burned

Analysis

We believe that the impact of EIP-1559 on both miner revenue and ETH holders has not been well explored. The main reason this analysis has been difficult before is that miner-extractable value has started to make up a large share of miner revenue due to constant arbitrage opportunities in Defi.

To give you a quick refresher

The revenue miners receive, and that EIP-1559 stands to affect, currently consists of three sources:

- A block subsidy of 2 ETH per block as well as an extra reward for uncle blocks.

- Fees from users who bid for inclusion in the blockspace market (irrespective of their final position in the block).

- And third, the difficult-to-quantify but very high value miners can extract by inserting (or not inserting) transactions at specific points in the block. This is called miner-extractable value, or MEV, and most miners currently “outsource” it to frontrunning and arbitrage bots, who run bidding auctions with each other in the mempool.

After activation of EIP-1559, miners will continue to receive the same revenue from the block subsidy and MEV. The value from inclusion fees would be burned as long as the system isn’t congested (demand below the maximum gas limit). When demand exceeds the maximum gas limit, there would be an additional first-price auction between transactors, with the proceeds going to miners. (Source)

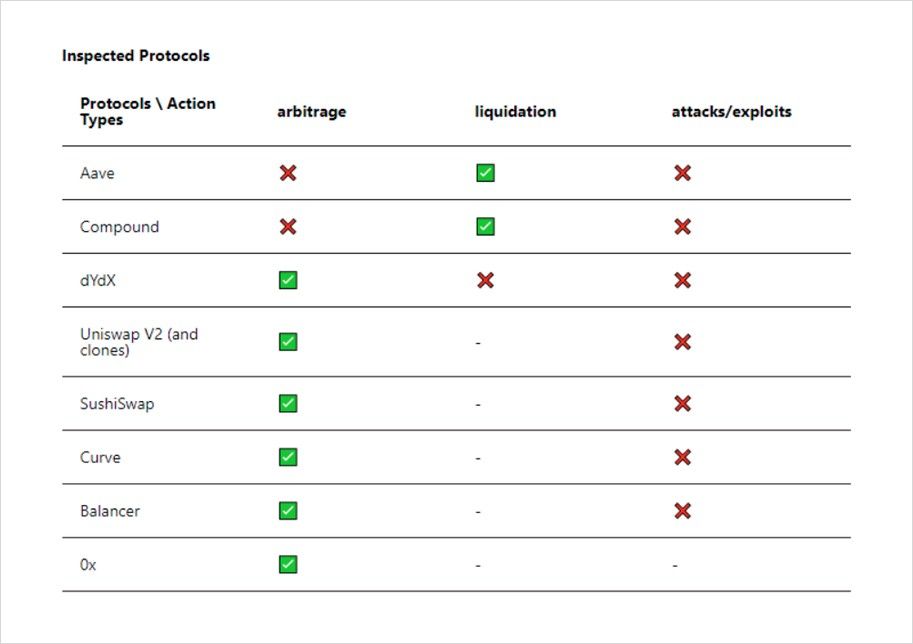

Fortunately, last week we saw the launch of Flashbot’s MEV dashboard. This project can identify MEV transactions by looking for certain MEV generating patterns (this is done by inspecting every call performed along the transaction’s execution trace). The full methodology can be seen here. In combination with overall revenue, we can now correctly assign transaction types to their correct buckets.

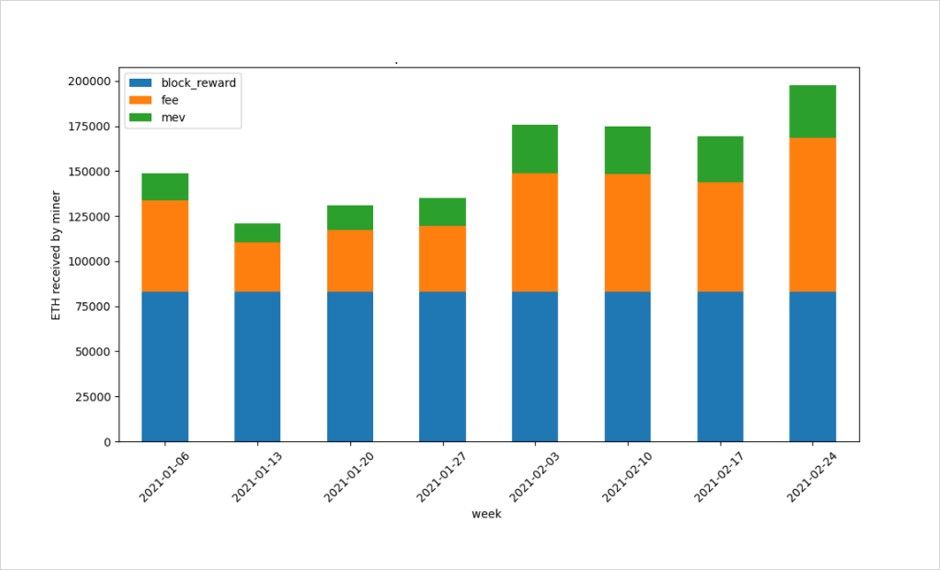

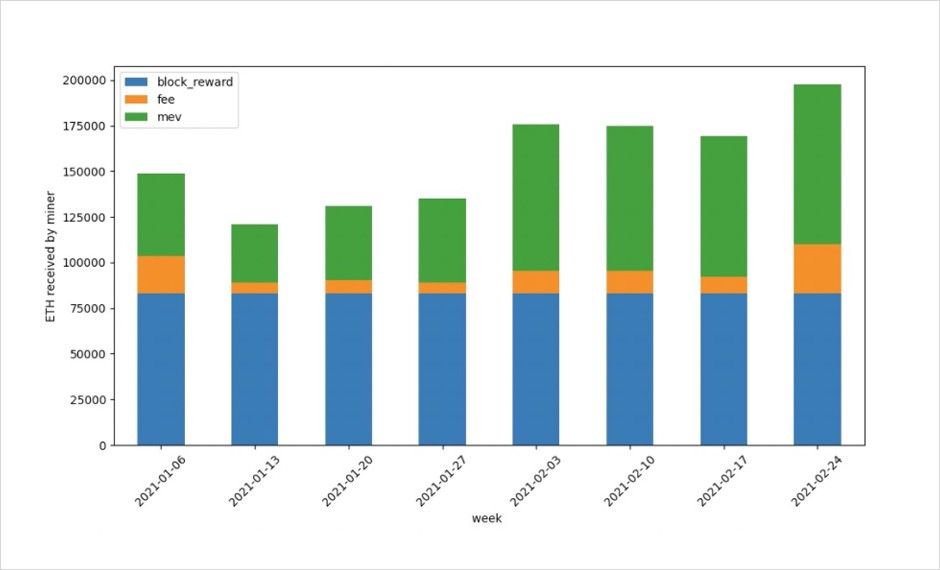

Chart 1: Establishing the absolute lower bound

Using the data of flashbots.net allows us to establish an absolute lower bound for fee revenue from MEV extraction. Chart 1 makes the assumption that no MEV exists beyond what flashbots can already recognize. But as you can see from the below methodology, many protocols and transaction types are still missing and will only be added over time.

(Source)

So we know this assumption is false, but it presents an absolute lower bound for fee revenue from MEV extraction that we can now build on.

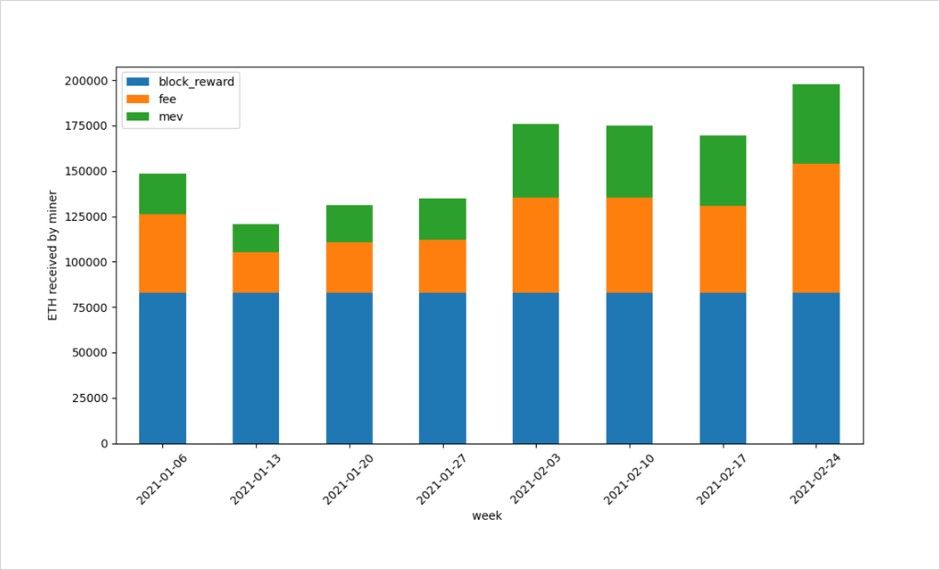

Chart 2: 67% of MEV is correctly classified

The second chart assumes that flashbots correctly classifies 67% of the MEV that is currently extracted by miners. We can visualize this assumption by multiplying the share of MEV among all transaction fees by 1.5.

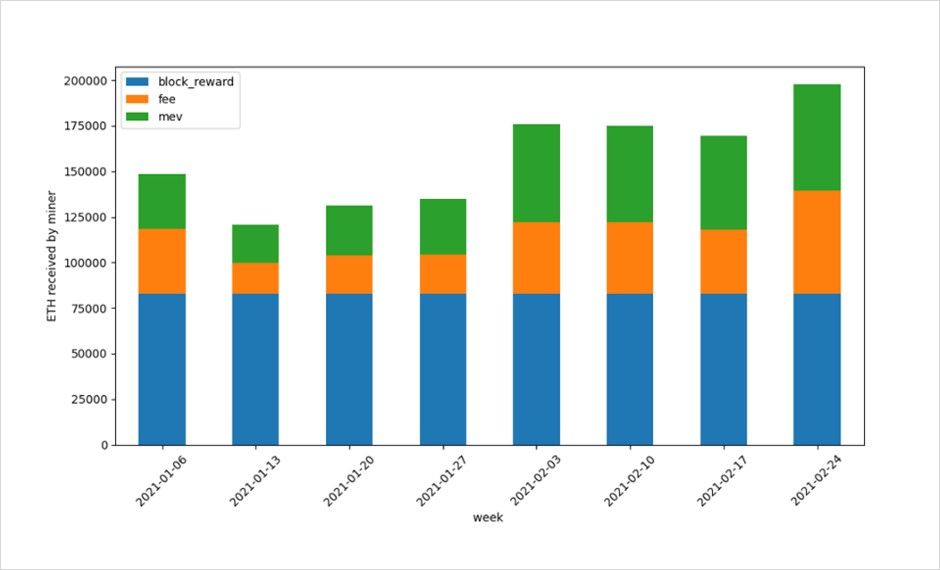

Chart 3: 50% of MEV is correctly classified

The third chart assumes that half of current MEV is correctly classified by flashbots. We can visualize this assumption by multiplying the share of MEV among all transaction fees by 2.

Chart 4: 33% of MEV is correctly classified

In the fourth chart, we can see the distribution under the assumption that only 33% of current MEV is correctly classified by flashbots. We don’t believe this is correct today, but we do strongly believe that this where Ethereum is headed and that it will become true in less than 12 months. That is because the range of possible MEV is constantly expanding and extraction methods are becoming more sophisticated, while user demand to transact does not necessarily increase at the same pace.

Shortfalls of this analysis

- Non-MEV transactions will also pay tips when the chain is congested, so miners will receive some of the orange area (congestion fee) as well

- MEV transactions also pay a basefee, so miners lose some of the green area. Though we believe it is negligible compared to the value stored in the tip

- Our analysis does not capture MEV that miners extract directly, e.g. via including their own transactions.

Conclusion

We can see that circulating estimates that EIP-1559 would burn over 50% of miner revenue are completely unfounded. Depending on how much unclassified MEV we missed, our guesses range from 20% to 35% at most. These numbers still don’t represent credible upper bounds, since not only has flashbots not yet correctly classified the entire Dark Forest, but the Dark Forest itself is always expanding.

Resources

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the authors and is not made on behalf of Paradigm or its affiliates and does not necessarily reflect the opinions of Paradigm, its affiliates or individuals associated with Paradigm. The opinions reflected herein are subject to change without being updated.